capital gains tax increase retroactive

Treasury Secretary Janet Yellen suggested in remarks before a Senate panel that if Congress were to pass a capital-gains tax hike effective starting in April 2021 that wouldnt count as a retroactive increase. The Administration leaked Thursday that its new high rate would apply to all gains.

The Capital Gains Rate Historical Perspectives On Retroactive Changes Lexology

June 16 2021 1108 AM PDT Treasury Secretary Janet Yellen suggested in remarks before a Senate panel that if Congress were to pass a capital-gains tax hike effective starting in April 2021 that.

. Still another would make the change. Specifically the Greenbook proposes to tax long-term capital gains and qualified dividends of taxpayers with adjusted gross income of more than 1 million at ordinary. Newer Post Older Post Home.

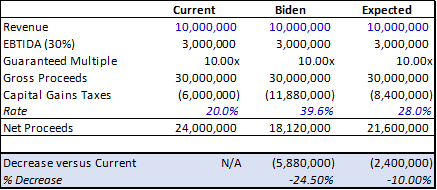

Earlier this year President Biden proposed a 2022 budget for the federal government along with a Greenbook explaining corresponding proposed changes to the tax code. The capital gains tax. Not only does he want to raise taxes on capital gains to a modern high of 434 he wants to do it retroactively.

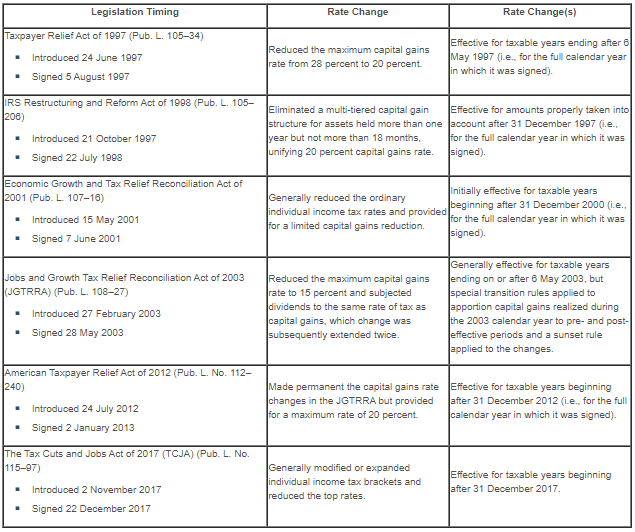

Reduced the maximum capital gains rate from 28 percent to 20 percent. Iklan Tengah Artikel 1. If the capital-gains rate is increased millionaire and billionaire taxpayers would actually face a 434 tax on capital asset sales when factoring in a 38 tax linked to the Affordable Care Act.

Signed 5 August 1997. The only major capital gains rate increase since 1980 was not made retroactive. Thus the capital gains tax excluding the surtax for 2020 would be 800000 20 times 4 million.

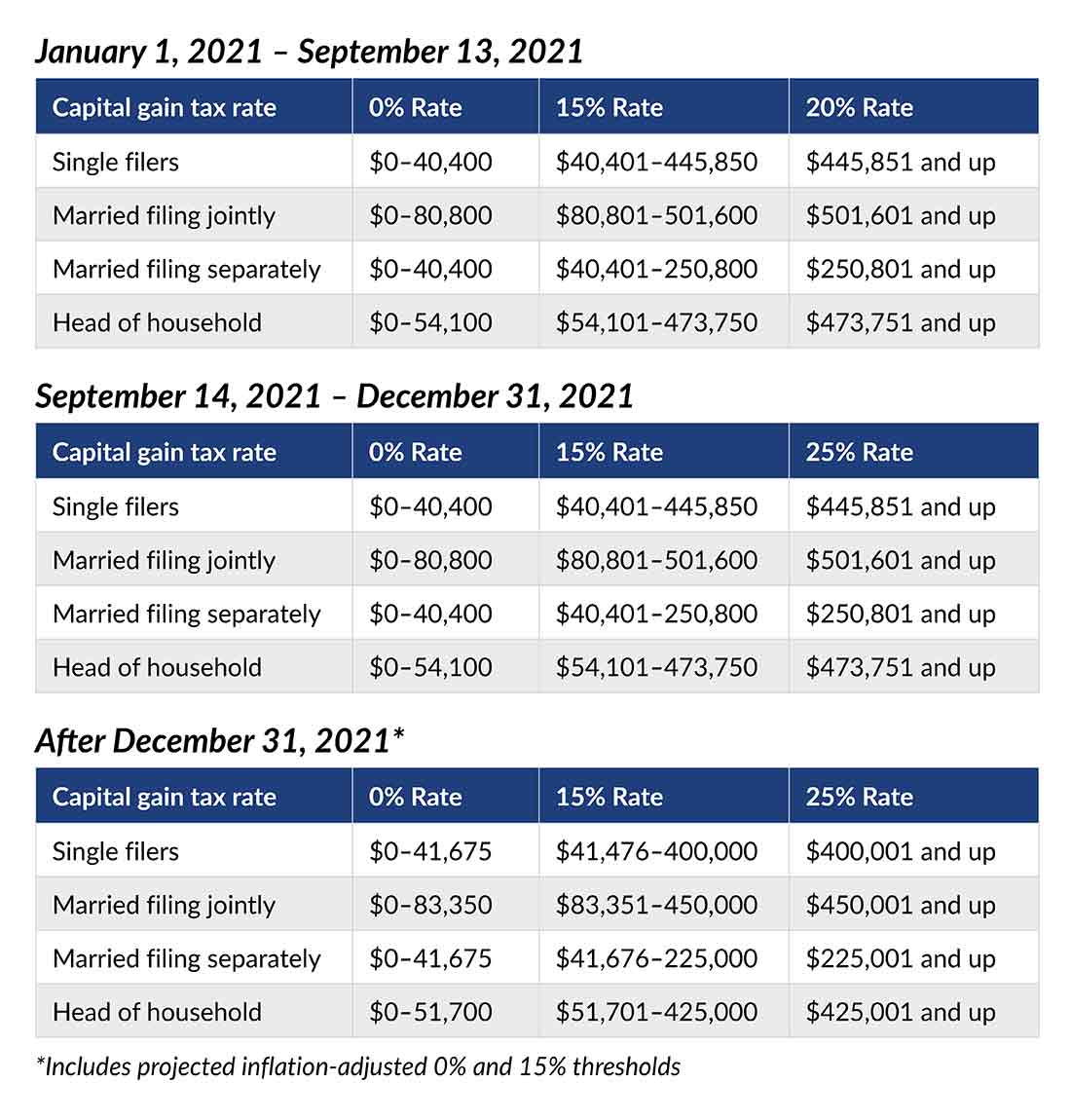

Perhaps the most newsworthy item in the Treasury Department Greenbook was the Biden Administrations proposal to increase taxes on capital gains on a retroactive basis. I dont see a prospective change in rules pertaining to the taxation of future realization of capital gains as being a retroactive feature Yellen told the Senate Finance. Biden plans to increase the top tax rate on capital gains to 434 from 238 for households with income over 1 million though Congress must OK any hikes and retroactive effective dates the.

Hike to the capital gains inclusion rate may occur in the next federal budget. Iklan Tengah Artikel 2. If a change to the capital gain inclusion rate is announced in the upcoming budget it is not known whether it would be effective immediately be retroactive or start at a future date.

Another would raise the capital gains tax rate to 396 for taxpayers earning 1 million or more. Retroactive tax rate decreases unsurprisingly tend to be more welcomed by the public. This change has and could cause more disruption and volatility to the market as shareholders panic and quickly sell.

Even if legal retroactive tax rate increases can be politically unpopular amongst constituents and lawmakers alike for obvious reasons. President Joe Biden unveiled a budget proposal Friday calling for a 396 top capital gains tax rate matching previous outlines to help pay for the American Families Plan. Biden S Green Book Includes Retroactive Capital Gains Tax Increase Husch Blackwell Llp Jdsupra The Capital Gains Rate Historical Perspectives On Retroactive Changes Lexology Share this post.

This would mean actions taken now which under the current tax. Yellen Argues Capital Gains Hike From April 2021 Not Retroactive. One idea in play is a retroactive capital gains tax increase raising the top tax rate currently 238 percent imposed on the gain from the sale of assets held longer than a year9 President Bidens budget proposal suggested raising the rate on such capital gains to 434 percent for households with income over 1.

As expected the Presidents proposal would increase the top marginal ordinary income tax rate from 37 to 396 and would apply ordinary income tax rates to capital gains. If you would like to plan for a potential increase in the inclusion. Retroactive Tax Increase.

Equally concerning to the more affluent taxpayers is the possibility that tax increases will be retroactive to the beginning of 2021. The proposed budget would increase the taxes on capital gains for Americans earning more than 1 million to 434 which makes the rate the same as these individuals regular income tax rate completely eliminating the tax benefits of capital gains. Accordingly there is nothing stopping Congress from passing the Biden tax plan and making the proposed 396 top capital gains rate retroactive to some point earlier this year.

Treasury Secretary Janet Yellen suggested in remarks before a Senate panel that if Congress were to pass a capital-gains tax hike. With no tax law changes your client would expect capital gains tax.

Understanding The Proposed Retroactive Capital Gains Tax Rate Increase Frazier Deeter Llc

Private Equity Faces Increase In Capital Gains Tax Rate Our Insights Plante Moran

Possible Retroactive Capital Gains Hike Panics Investors Qsbs Holders Could Be At Risk Qsbs Expert

What Can The Wealthy Do About Biden S Proposed Tax Increases

Biden S Ex Post Facto Capital Gains Tax Increase Wsj

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

Capital Gains Tax Increases Will Accelerate M A Activity In 2021capital Gains Tax Increases Will Accelerate M A Activity In 2021

Tax Increases Are Coming Or Are They Bny Mellon Wealth Management

2021 2022 Proposed Tax Changes Wiser Wealth Management

Advisers Blast Biden S Retroactive Capital Gains Proposal

A Probable Capital Gains Tax Rate Increase And The Potential In Opportunity Zones Caliber

Biden S Proposed Retroactive Capital Gains Tax Increase

Retroactive Effective Date For Capital Gains Tax Increase Is A Bad Idea

Wall Street Panicking That Biden S Tax Hikes Will Be Retroactive

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

Managing Tax Rate Uncertainty Russell Investments

.png)

Biden S Green Book Includes Retroactive Capital Gains Tax Increase Husch Blackwell Llp Jdsupra

Proposed Impactful Tax Law Changes And What You Can Do Now Johnson Pope Bokor Ruppel Burns Llp